Employment Wage Subsidy Scheme (EWSS) Guidelines

The Employment Wage Subsidy Scheme (EWSS) will replace the Temporary Wage Subsidy Scheme (TWSS) from 1 September 2020. The EWSS provides a flat-rate subsidy to qualifying employers based on the numbers of paid and eligible employees on their payroll. The EWSS replaces the TWSS for pay dates on or after 1 September 2020 and is expected to continue until 31 March 2021. The scheme can be backdated to the 1 July in certain limited circumstances.

The scheme is open to employers who file their payroll submissions electronically through Revenue Online Service (ROS).

The scheme has two elements as follows:

- It provides a flat-rate subsidy to qualifying employers based on the numbers of paid and eligible employees on the employer’s payroll; and

- It charges a reduced rate of employer PRSI of 0.5% on wages paid which are eligible for the subsidy payment.

Eligibility for the scheme

- Employers must possess a valid tax clearance certificate to enter the EWSS and continue to maintain tax clearance for the duration of the scheme.

- Employers must be able to demonstrate that:

- their business will experience a 30% reduction in turnover or orders between 1 July and 31 December 2020,and

- this disruption is caused by COVID-19

This reduction in turnover or orders is relative to:

- the same period in 2019 where the business was in existence prior to 1 July 2019

- where the business commenced trading between 1 July and 1 November 2019, the date of commencement to 31 December 2019; or

- where a business commenced after 1 November 2019, the projected turnover or orders for 1 July 2020 to 31st December 2020.

Continued Review of Employer Eligibility required

Employers are required to undertake a review on the last day of every month (other than July 2020 and the final month of the scheme) to ensure they continue to meet the above eligibility criteria.

If employers no longer qualify, they must deregister for EWSS through ROS with effect from the following day (that being the 1st of the month) and cease claiming the subsidy.

If an employer becomes aware prior to the end of the month that they will no longer meet the eligibility criteria (e.g. unexpected donation or grant received at the start of a month), they should deregister immediately and cease to claim subsidies.

If circumstances change the following month and the employer is again eligible, they can reregister and claim from the date of reregistration. It is not possible to backdate the claim to include the period of deregistration as that correctly reflected the employer’s expectation at that time.

Eligible Employees

A subsidy can be claimed in respect of employees of an impacted business on the payroll and in receipt of gross wages of between € 151.50 and € 1,462 per week (subject to limited exceptions) during the period of the scheme (1 September 2020 to 31 March 2021).

Certain categories of employees are specifically excluded in legislation, those being:

- Proprietary Directors. However, in recognition of key role played by certain proprietary directors in providing employment to others, especially in the SME sector, it has been agreed that EWSS can be claimed in respect of certain proprietary directors. Additional guidance will be provided in due course.

- Connected Parties who were not on the payroll and paid at any time between 1 July 2019 and 30 June 2020. Connected parties include brothers, sisters, linear ancestors, linear descendants, aunts, uncles, nieces, nephews of an individual and their spouse. A person is connected to a company if they alone or together with their connected parties can exercise or acquire control of more than 50% of the issued share capital or voting rights, the greater part of distributions, or the greater parts of assets distributed on winding up.

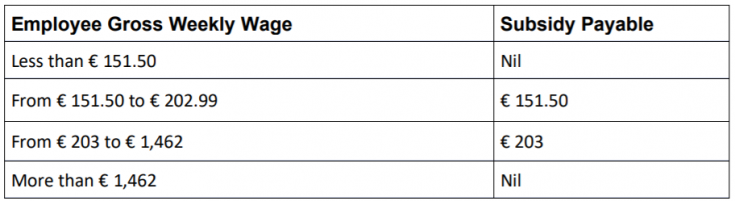

Rate of Subsidy

The rate of weekly subsidy the employer will receive per paid eligible employee is as follows:

For pay periods other than weekly, gross weekly wage will be calculated by dividing the returned gross wage by the number of insurable weeks included (subject to maximum divisors set by the system).

Registration for the Scheme

Eligible employers, or their payroll or financial agents, will be able to register for EWSS through ROS from 18th August. The date of registration cannot be back dated prior to the date of application and does not need to be back dated if a claim will be submitted in respect of payments in July/August.

July/August 2020

In recognition of the exclusion from TWSS of new entities, seasonal employees, and new hires, EWSS eligible employers, in respect of eligible employees, can backdate a claim for EWSS to 1 July 2020 in certain limited circumstances as follows:

- The employer was not eligible for TWSS; or

- The employer had employees not eligible for TWSS. This does not extend to employees whose net wages exceed that which allowed TWSS be claimed in respect of them due to tapering.

Payment of the subsidy

The subsidy will be paid directly into the employer’s designated bank account once a month in arrears, as soon as practicable after the return due date (14th of the following month).

Any subsidies due can be offset against outstanding tax liabilities if requested by employers.

Further guidance can be found in Revenues Guidelines on the operation of the Employment Wage Subsidy Scheme: https://www.revenue.ie/en/corporate/communications/documents/ewss-guidelines.pdf

Restart Grants

On Monday, the Department of Business, Enterprise, and Innovation (DBEI) launched the Restart Grant Plus scheme, which provides grants to businesses to help them reopen their premises and get back to work. Grants of between €4,000 up to a maximum of €25,000 are available. To qualify for the scheme, enterprises must have:

- 250 employees or less,

- turnover of less than €100,000 per employee, and

- reduced turnover by at least 25% as a result of COVID-19

Under the Restart Grant Plus scheme, support will also be provided for enterprises that could not access the original grant scheme, including rateable sports businesses and trading charity shops. Non-rated B&Bs will be eligible for a grant payment of €4,000.

Businesses can apply through their Local Authority. Applications will open shortly for non-rated B&Bs who must apply to Fáilte Ireland.

Revamped Enterprise Support Grant launched for the self-employed

On Friday 14th August, Minister for Social Protection, Community and Rural Development and the Islands Heather Humphreys T.D. opened applications for the newly revamped Enterprise Support Grant. This grant, worth up to €1,000 per person, is aimed at sole traders who do not pay commercial rates and therefore do not qualify for the Government’s Restart Grant Plus Scheme. Grants will be awarded on costs related to reopening a business, including, safety measures, business advice or mentoring, repairs, fuel, and wages.

The Enterprise Support Grant will be available to self-employed individuals who:

- are tax and PRSI compliant,

- are not liable for commercial rates,

- have been in receipt of the Covid-19 Pandemic Unemployment Payment or a Jobseekers payment and have closed their claim on or after 18 May 2020,

- have reopened their business which was closed due to COVID-19,

- employ less than 10 people,

- have an annual turnover of less than €1 million,

- are not eligible for COVID-19 Business Restart Grant or similar COVID-19 business re-start grants from other government department, and

- can produce VAT receipts/invoices in respect of business re-start costs and expenses claimed, if requested to do so.