Revenue’s Guidelines on the Employment Wage Subsidy Scheme (EWSS) were recently updated to include further guidance as follows:

Extension of the scheme until 30 June 2021

The update to the Guidelines reflects the recent extension of the scheme to 30 June 2021 and the dates on which businesses are required to complete their rolling monthly reviews of whether they qualify for the scheme.

Continued Review of Employer Eligibility required

Employers must undertake a review of the six-month period on the last day of every month (other than July 2020 and the final month of the scheme) to be satisfied whether they continue to meet the above eligibility criteria and to take the necessary action of withdrawing from the scheme where they do not.

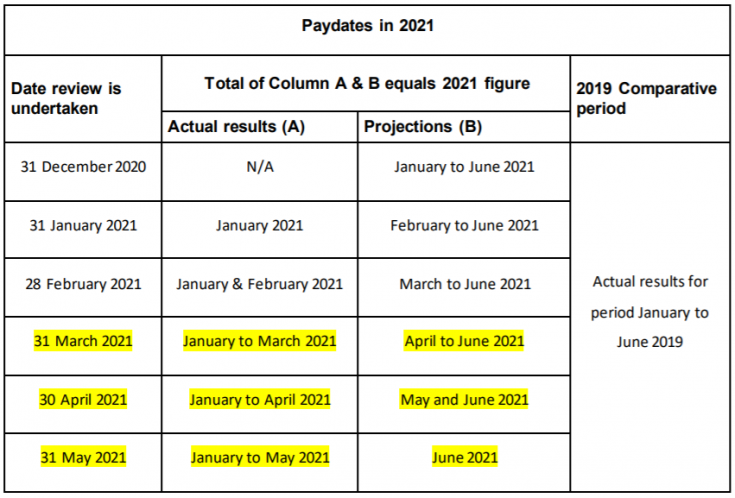

This review must be undertaken on a rolling monthly basis comparing the actual and projected business performance over the specified period (July to December 2020 for 2020 pay dates and January to June 2021 for 2021 pay dates) as illustrated below:

If an employer no longer qualifies, they must deregister for EWSS through “Manage Tax Registration” on ROS with effect from the following day (that being the 1st of the month) and cease claiming the subsidy. This means that an employer must not select “Employment Wage Subsidy Scheme” from the “Other Payments” section in their payroll software or on the ROS manual payroll reporting facility.

If an employer becomes aware prior to the end of the month that they will no longer meet the eligibility criteria (e.g., unexpected donation or grant received at the start of a month), they should deregister immediately and cease to claim subsidies.

Subsidies correctly claimed in accordance with the terms and conditions of the scheme prior to deregistration will not be repayable.

If circumstances change the following month and the employer is again eligible, they can reregister and claim from the date of reregistration. It is not possible to backdate the claim to include the period of deregistration as that correctly reflected the employer’s expectation at that time.

Restart Grant

For the purposes of qualifying for the EWSS and on a without prejudice basis, Revenue regards the Restart Grant as capital in nature and therefore it is not included in the definition of turnover for the purposes of assessing employer eligibility for EWSS.

However, this does not reflect the general tax treatment of the Restart Grant. Where the grant is used by a sole trader to defray expenditure which is revenue in nature, such as utility or insurance expenses costs, it will be taken into account when calculating the trader’s taxable trading profits.

Where the grant is used to fund the acquisition of plant and machinery for use in the sole trader’s business, expenditure which is capital in nature, the trader will be entitled to claim capital allowances in respect of that expenditure net of the grant received. A similar treatment applies for a company in receipt of the restart grant or restart grant plus.

The update to the Guidelines also reflects the recent extension of the scheme to 30 June 2021 and the dates on which businesses are required to complete their rolling monthly reviews of whether they qualify for the scheme.

Debt Warehousing of TWSS Liabilities

Under the provisions of Financial Provision (Covid-19) (No.2) Act 2020 the Government has legislated to allow for debt associated with the COVID-19 crisis to be deferred or ‘warehoused’. The scheme allows for the deferral of unpaid VAT and PAYE (Employers) debts arising from the COVID-19 crisis for a period of 12 months after a business resumes trading.

The scheme has since been extended to include TWSS liabilities. The debts can then be addressed by way of a phased payment arrangement at a lower interest rate of 3% per annum which represents a significant reduction from the standard rate of 8% or 10% per annum depending on the particular tax owed.

Further Information can be found in Revenues updated Guidelines on the operation of the Employment Wage Subsidy Scheme: