Employers who wish to pay an employees’ 2020 tax liability arising due to TWSS

Revenue will facilitate employers who wish to pay employees’ 2020 tax liabilities arising on subsidy payments made under the Temporary Wage Subsidy Scheme (TWSS), without the application of a Benefit-in-Kind (BIK) charge. This applies to Income Tax (IT) and Universal Social Charge (USC) liabilities which arise due to the TWSS.

The BIK exemption will also be available where the employer partially discharges an employee’s TWSS liability but does not discharge the full amount.

Revenue has noted that the facility is available for PAYE employees and at the moment it does not apply to self-assessed staff (e.g. proprietary directors).

Employers must engage directly with employees and agree the method to pay the liability involved.

In January 2021, Revenue will make a Preliminary End of Year Statement for 2020 available for each employee. This will assist in determining the amount of IT and USC due if any. Revenue have confirmed that they will not be issuing paper notices of the Preliminary End of Year Statements (PEOYS) to persons who are not registered for myAccount.

How to pay your employees’ tax liabilities

To pay employees’ tax liabilities an employer can:

- provide funds to each employee to meet their IT and USC liabilities, as shown in their Preliminary End of Year Statement. Each employee must then pay their liability via RevPay.

or

- amend the last payroll submission of 2020. You must add additional ‘IT paid’ and ‘USC paid’ that equals the liability shown on the Preliminary End of Year Statement. This must be done for each employee concerned. Some payroll packages do not provide this facility. It may be necessary to enter the information manually through Revenue Online Service (ROS).

You need to pay the additional amounts that are notified via a revised monthly statement issued by Revenue.

The employee’s Preliminary End of Year Statement will be recalculated subsequently. This will show the additional IT and USC liabilities paid directly by the employer.

For both options above, each employee must complete their 2020 Income Tax Return.

(Note: This facility is limited to payments made by employers on behalf of their employees up to end June 2021. This is to avoid any abuse of this arrangement.)

Documentation and records

You must retain copies of any documentation and records covering your:

- engagement with your employees about these arrangements

- agreement to undertake these payment arrangements

- benefit-in-kind

Revenue will not apply Benefit-in-kind rules to these payments you make on behalf of your employees.

Legislation

Employers paying amounts to settle these employee IT liabilities will not receive a deduction under the Taxes Consolidation Act, 1997, Section 81(2)(a).

These payments would not be regarded as wholly and exclusively incurred for the purposes of the employer’s trade or profession. Furthermore, Section 81(2)(p) specifically denies a deduction in respect of any taxes on income.

Further guidance can be found on Revenues website at:

https://www.revenue.ie/en/employing-people/twss/employers/index.aspx

Revenue confirms Debt Warehousing Scheme remains available to support businesses impacted by current Level 5 restrictions

Revenue confirmed on the 13th of January 2021 that the Debt Warehousing Scheme remains available to support businesses experiencing tax payment difficulties arising from the current COVID-19 Level 5 public health restrictions, which are to remain in place until at least 31 January 2021.

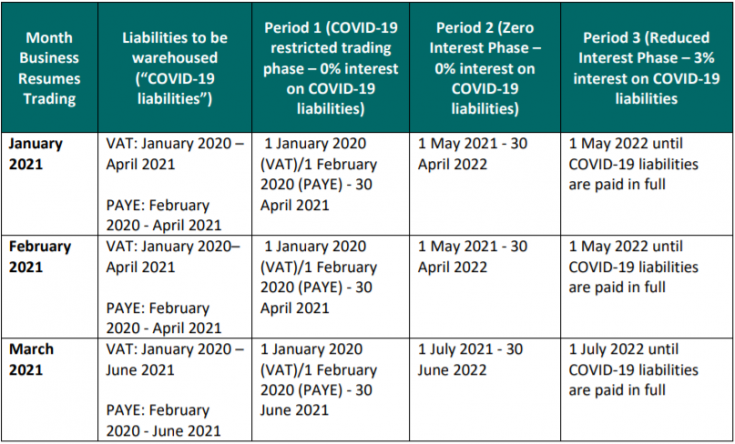

The Debt Warehousing Scheme allows businesses to ‘park’ PAYE (Employer) and VAT tax debts arising from the COVID-19 crisis, as well as self-assessed income tax amounts (balance of 2019 Income Tax liability and 2020 preliminary tax) and Temporary Wage Subsidy Scheme overpayments. These debts can be ‘parked’ on an interest free basis for 12 months following resumption of trading. At the end of the 12-month interest free period, the warehoused debt may be paid in full without incurring an interest charge or paid through a phased payment arrangement at a significantly reduced interest rate of 3% per annum. This compares to the standard rate of 10% per annum that would otherwise apply to such debts.

Following the recent move to Level 5 restrictions, Revenue confirmed that this vital liquidity support remains available, and businesses which have had to close can continue to warehouse current VAT and PAYE (Employer) liabilities.

The terms of the scheme remain the same in that access is automatic for SMEs and on request for larger businesses.

It also remains a requirement that the business continues to file all relevant tax returns for the restricted trading period(s) so that the tax debt can be included in the warehousing scheme.

2021

Liabilities available for warehousing are as follows:

Further guidance can be found in Revenues Information Booklet on Warehousing of Tax Debts Associated with Covid-19:

Brexit

The United Kingdom left the European Union on 31 December 2020. Great Britain will no longer be treated as it if is a full EU Member State for VAT purposes.

VAT – Trade between Ireland and Northern Ireland after the transition period

Trade in goods with Northern Ireland

The Protocol on Ireland/Northern Ireland provides that Northern Ireland will continue to be treated as an EU Member State with regard to VAT on goods and as a result they will be subject to the same EU VAT rules on goods as other EU Member States.

This means the supply and movement of goods between Northern Ireland and Ireland in either direction will be unchanged, and the movement of these goods will continue to be accounted for as an intra-community supply and acquisition.

The Electronic VAT Refund (EVR) system can be used to reclaim VAT expended on goods in NI.

Trade in services with Northern Ireland

Northern Ireland will not be treated as a Member State with regard to VAT on services. If you supply services to NI different place of supply rules for VAT on services may apply.

The place of supply rule to be applied depends on whether the customer is a business or a consumer.

For Business to Business (B2B), the place of supply is the place where the business receiving the services is based. If you receive services from a NI-based company after the transition period, in general, Irish VAT will be due on the services.

If you provide services to a NI-based company after the transition period, in general, UK VAT will be due on the services. (See table below for guidance on who is a liable for the VAT).

For supplies of Business to Company (B2C) services, in general, the place of supply is the place where the supplier of the services is based.

Exporting goods to Great Britain

The sale of goods from Ireland to Great Britain should be treated as exports, with no Irish VAT applicable.

Importing goods from Great Britain

The same rules should apply to the sale of goods from Great Britain to Ireland with no UK VAT chargeable, however, import VAT will arise on the importation of goods into Ireland from Great Britain. VAT is applied at the applicable Irish VAT rate and is payable at point of importation.

If you are a VAT registered trader, you are generally entitled to take credit for VAT paid on goods imported for the purposes of your business. You must claim this credit in your return in the taxable VAT period concerned, subject to the normal restrictions.

Trade in services with Great Britain

The place of supply rule to be applied depends on whether the customer is a business or a consumer.

For Business to Business (B2B), the place of supply is the place where the business receiving the services is based. If you receive services from a UK-based company after the transition period, in general, Irish VAT will be due on the services.

If you provide services to a UK-based company after the transition period, in general, UK VAT will be due on the services. (See table below for guidance on who is a liable for the VAT).

For supplies of Business to Company (B2C) services, in general, the place of supply is the place where the supplier of the services is based.

Further guidance on Brexit can be found in Revenues website at:

https://www.revenue.ie/en/customs-traders-and-agents/brexit/index.aspx

Economic Operators’ Registration and Identification (EORI) number

The EORI online registration service allows you to register for an EORI number online. If you are a trader who imports or exports goods into or out of the European Union (EU), you will need an EORI number. This number is valid throughout the EU. It is used as a common reference number for interactions with the customs authorities in any Member State.

Further information on how to apply for an EORI number can be found on Revenues website at:

https://www.revenue.ie/en/online-services/services/common/register-for-an-eori-number.aspx

Postponed accounting for VAT in Imports

Postponed accounting for VAT on imports is now available to all VAT registered traders.

The Revenue Commissioners may exclude traders who do not fulfil certain conditions and requirements from using this scheme.

This scheme:

- provides for postponed accounting for VAT on imports from non-EU countries

- enables you to account for import VAT on your VAT return

- allows you to reclaim VAT at the same time as it is declared in a return. This is subject to normal rules on deductibility.

The Revenue Commissioners may exclude traders who do not fulfil certain conditions and requirements from postponed accounting. The conditions and requirements which must be fulfilled will include compliance with tax and customs law. A business may also be required to satisfy Revenue of the viability of their business operations and their capacity to pay their VAT liabilities.

Further guidance can be found in Revenues Tax and Duty Manual, VAT – Postponed Accounting: